E-reports software

Key features

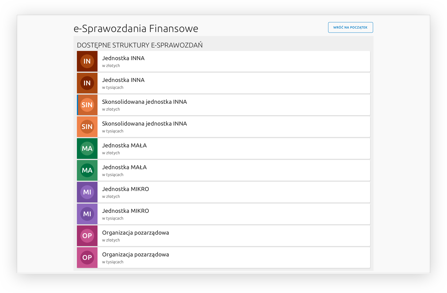

Creating any E-report structure

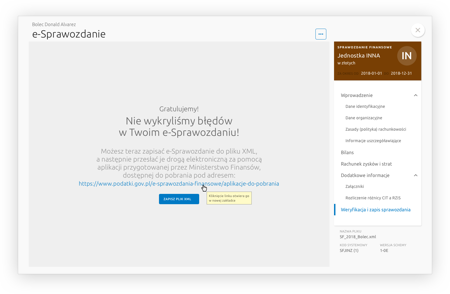

Creating any E-report structure  Ability to save and upload an E-report file

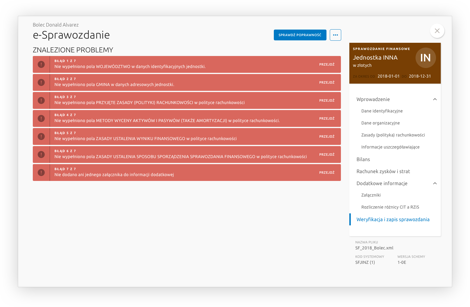

Ability to save and upload an E-report file  Verification of the correctness of the E-report before sending it

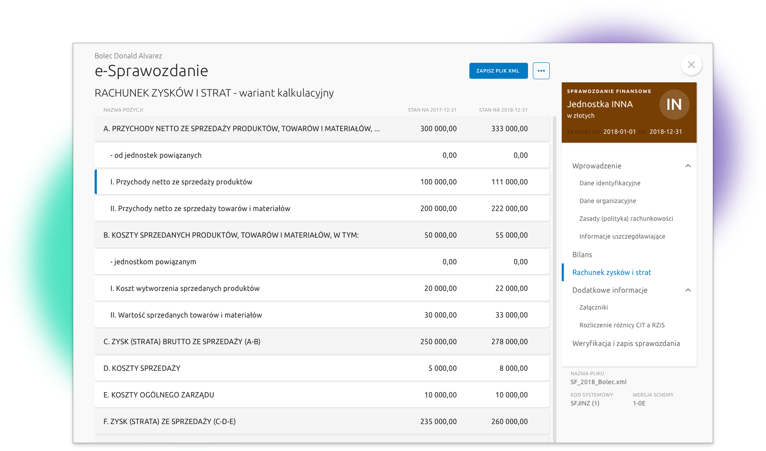

Verification of the correctness of the E-report before sending it  Automation of calculations in all statements in the application

Automation of calculations in all statements in the application  Handling cash flow statements and statements of changes in capital

Handling cash flow statements and statements of changes in capital  Hints in each section to facilitate the correct preparation of the report

Hints in each section to facilitate the correct preparation of the report E-reports available

All entities that prepare the basic, complete version of the financial statements, as defined in Appendix 1 of the Accounting Act of 29 September 1994.

* version of the consolidated report available in the additional package,

Micro-enterprises.

Companies which, in each of the last two financial years, did not exceed at least two of the following three sizes:

PLN 1,500,000 - in the case of total balance sheet assets at the end of the financial year

PLN 3,000,000 - in the case of net revenue from sales of goods and products for the financial year

10 persons - in the case of average annual full-time employment;

And natural persons whose net revenues from the sale of goods, products and financial operations amounted to the equivalent in the Polish currency of not less than EUR 2,000,000 and not more than EUR 3,000,000 for the previous financial year.

Small entities.

Companies which, in each of the last two financial years, did not exceed at least two of the following three sizes:

PLN 25,500,000 - in the case of total balance sheet assets at the end of the financial year

PLN 51,000,000 - in the case of net revenue from sales of goods and products for the financial year

50 persons - in the case of average annual full-time employment;

And natural persons who apply accounting principles pursuant to Article 2(2) of the Accounting Act.

Non-governmental organisations.

Entities defined in the Act of 24 April 2003 on public benefit activity and voluntary work, e.g. foundations, associations.

Brokerage houses.

Entities required to prepare financial statements in accordance with the Regulation of the Minister of Finance of 28 December 2009 on specific accounting principles for brokerage houses.

* version for brokerage houses available in an additional package